It's a shame that hundreds, if not thousands, of injured workers underwent unnecessary spinal fusion surgeries and must live with the debilitating aftermath of significant disability because of people whose greed overrides the well being of fellow humans.

I had learned about Michael Drobot and Pacific Hospital of Long Beach, and their co-conspirators, preying on workers' compensation patients some time ago.

On Friday though, Federal prosecutors announced that Michael D. Drobot faces up to 10 years in prison after he pleaded guilty to paying kickbacks in a $500 million fraud scheme relating to spinal fusions and admitted to bribing state Sen. Ron Calderon to delay legislation to repeal the separate reimbursement for spinal hardware.

Calderon, D-Montebello, was indicted one day earlier on 24 charges, including bribery, money laundering, wire fraud and filing a false tax return. His brother, former...

[Click here to see the rest of this post]

Related articles

California state Sen. Ron Calderon accepted $88,000 in bribes, FBI affidavit alleges (workers-compensation.blogspot.com)

IMR: DWC Get Out of the Way (workers-compensation.blogspot.com)

One Claim Going OTOC (workers-compensation.blogspot.com)

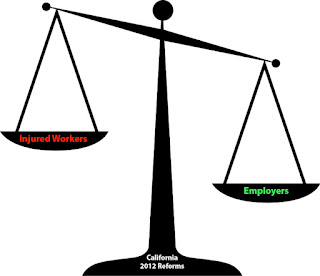

Work Comp Lost Focus (workers-compensation.blogspot.com)

OK's True Cost Control Feature (workers-compensation.blogspot.com)

The Conflict Between NAFTA and Comp (workers-compensation.blogspot.com)

Being Professional (workers-compensation.blogspot.com)

Read more about "Federalization of Workers' Compensation"

Jul 05, 2012

United States Supreme Court has taken a giant leap forward to facilitate the Federalization of the entire nation's workers' compensation system. By it's recent decision, upholding the mandate for insurance care under the ...

Dec 23, 2010

Yesterday the US Congress passed and sent to the President, The World Trade Center Health Program, marking yet another advance on the path to federalize the nation's workers' compensation program. The Federally ...

Jul 05, 2010

The trend toward Federalization of workers' compensation benefits took a giant step forward by recent Presidential action creating the British Petroleum Oil Compensation Fund. While the details remain vague, the broad and ...

Jun 14, 2012

Yesterday the US Congress passed and sent to the President, The World Trade Center Health Program, marking yet another advance on the path to federalize the nation's workers' compensation program. The Federally .