Copyright

Thursday, January 8, 2009

NJ Charges 11 Corporations for Massive Workers’ Compensation Insurance Fraud

Anne Milgram, NJ Attorney General, and Deborah L. Gramiccioni, Criminal Justice Director, informed the public that, "The indictments allege that the defendants lied on insurance applications and failed to remit insurance premiums to the insurance companies, instead keeping the money for themselves. It is also charged that the defendants laundered money so that the scheme would go undetected. As a result, many people were allegedly left without workers’ compensation insurance."

"The indictment alleges that between June 2003 and September 2007, Sciarra, a former licensed insurance producer, and his co-defendants fraudulently avoided premium payments for workers’ compensation insurance they obtained for clients. The defendants allegedly submitted falsified applications for workers’ compensation insurance by misrepresenting and omitting information in the applications. These misrepresentations included understating the number of employees leased, the kind of work those employees did and the number of past injury claims involving the employers, all factors that are relevant to determining the cost of workers’ compensation insurance. The defendants also are charged with failing to turn over money that was provided by clients of the PEOs to pay for insurance premiums."

The State of New Jersey has recently enacted legislation expanding its insurance fraud program. In December 2008 the NJ legislature passed and the Governor signed Senate Bill No. 1918 which requires the Insurance Fraud Prosecutor to establish liaison with the Department of Labor and Workplace Development and authorizes its investigation of cases for failure to provide workers' compensation coverage.

Thursday, December 27, 2012

Who Calls The Shots, Your Employer-Selected Doctor Or The Insurance Company?

Typically, when an authorized doctor suggests an expensive course of care (like surgery) the first thing the doctor will do is check with the insurance company to make sure the surgery is going to be paid for. Instead of immediately scheduling the needed surgery, the doctor will wait until the insurance carrier agrees to pay for the procedure. Doctors do this so they don’t have to worry about how they are going to be paid. Asking for this unneeded authorization from the insurance company means the insurance company now has a say in determining what individual procedures are proper for the care of the work injury.

We often see injured workers whose injury was initially accepted by the employer until the doctor requests authorization for an expensive surgery. When faced with the additional cost of surgery, the insurance carrier denies the work injury hoping the injured worker will either forego surgery or try to pay for the surgery through other means, such as their personal health insurance.

This situation may also arise when the authorized doctor recommends expensive diagnostic procedures, like CT scans, or refers the injured worker to a specialist, for example a psychiatrist for depression related to the work injury.

To make sure your rights are protected, it’s often helpful to have an experienced workers’ compensation attorney on your side if you’re facing a situation where your employer is trying to interfere with the decisions of their handpicked doctor. Injured workers should get the care that their doctor, not an insurance company, determines is medically appropriate.

Read more about "medical treatment" and workers' compensation.

Related articles

Tuesday, November 21, 2017

Insurance Companies May Offer Discounts for Wellness Programs

Wednesday, February 3, 2016

Fraud: Two South Jersey Corporations and Five of Their Officials Charged With Stealing Nearly $600,000

Saturday, September 6, 2014

3 Reasons Congress Should Renew TRIA

The Terrorism Risk Insurance Act (TRIA), enacted to re-insure insurance companies against terrorism losses is about to sunset. Today's post is shared from insurancejournal.com/

U.S. insurance markets, like the rest of the nation, were caught off guard by the Sept.11, 2001 terrorist attacks. Loss of life and property led to an estimated $32.5 billion dollars in insured losses – $43 billion in 2013 dollars – the largest amount ever to that point. Following that, terrorism risk insurance became either extremely expensive or unavailable.

Congress responded by passing the Terrorism Risk Insurance Act (TRIA) in 2002. The act provides government support for the commercial terrorism insurance market through mechanisms for spreading losses across the nation’s policyholders and using government funds to cover the most extreme losses. This has helped keep terrorism risk insurance affordable for businesses.

Congress extended the act in 2005 and again in 2007. However, with the program set to expire this year, Congress had to revisit a crucial question: What is the appropriate government role in terrorism insurance markets? The Rand Corp., a nonpartisan, nonprofit research organization, recently identified three emerging themes:

1.) The act’s expiration could increase federal spending following terror attacks. Many experts predict that the act’s expiration would increase the price and reduce the availability of terrorism coverage, resulting in a reduction in the number of businesses with terrorism coverage. If this occurred, more attack losses would go uninsured. This would increase demand for disaster assistance in the event of an...

[Click here to see the rest of this post]

Related articles

- AIA to Urge Renewal of TRIA to Workers Compensation (workers-compensation.blogspot.com)

- Fitch report: Workers comp will be hit hard if TRIA not extended (workers-compensation.blogspot.com)

- Illinois Employer to Pay $10K Penalty for Lack of Workers' Comp Insurance (workers-compensation.blogspot.com)

- Worried About Costs And Unaware of Help, Californians Head Into New Era of Health Coverage (workers-compensation.blogspot.com)

- NJ Workers Compensation Rates 2014 (workers-compensation.blogspot.com)

- Why More, Not Fewer, People Might Start Getting Health Insurance Through Work (workers-compensation.blogspot.com)

- Consumers Will Owe Uncle Sam If They Got Health Insurance Subsidies Mistakenly (workers-compensation.blogspot.com)

Monday, August 5, 2013

Illinois: Employer Convicted of a Felony for Failure to Have Workers' Compensation Insurance

Mr. Ahmed Ghosien, d/b/a Ghosien European Auto Werks, refused to comply with Illinois law despite having been given several opportunities to become compliant. After aggressive enforcement efforts, on July 25, 2013, Mr. Ghosien entered a guilty plea to the Class 4 felony (People v. Ahmed Ghosien, 12 CR 20949). This is the first felony conviction against an employer for failure to obtain workers’ compensation insurance since the penalty increase, from a misdemeanor to a Class 4 felony, was introduced in 2005 and remained a critical part of Gov. Quinn’s reforms to the Worker’s Compensation Act in 2011.

Tuesday, October 6, 2009

NJ Commissioner of Labor Adopts Rules for Emergent Medical Motions in Workers Compensation Matters

David J. Socolow, Commissioner of Labor and Workforce Development, on September 3, 2009, formally adopted the pending Rules for Emergent Medical Motions. The new Rules became effective on Monday, October 5, 2009 and a notice published in the NJ Register on that date, 41 NJ Register 3807(a).

A public hearing concerning the pending Rules was held on June 2, 2009 and there were no attendees. A written comment was submitted by Kenneth A. Stoller, Senior Counsel, American Insurance Association, Washington, DC. One comment concerned the assessment of fines against an insurance carrier for activities of the employer. The Department declined to modify the pending Rules, but stated, “…the insurance carrier would not be fined or penalized where it is in no way culpable for the violation.”

A typographical correction was recognized. “Upon review, the Department has noticed a typographical error, which it would like to correct through a change on adoption. Specifically, the reference within proposed N.J.A.C. 12:235-3.3(r) to, "the decision and order rendered under (o) above," should read, "the decision and order rendered under (q) above..." Consequently, the Department is substituting "(q)" for "(o)" within N.J.A.C. 12:235-3.3(r).”

The Honorable Peter J. Calderone, Director and Chief Judge of the Division, will discuss the new Rules in an upcoming academic seminar sponsored by the NJ Institute for Continuing Legal Education on Wednesday, October 7, 2009.

………

The Rules:

12:235-3.2 General motions for temporary disability and/or medical benefits

(a)-(i) (No change.)

12:235-3.3 Motions for emergent medical care pursuant to N.J.S.A. 34:15-15.3

(a) With or after the filing of a claim petition, a petitioner may file a motion for emergent medical care directly with the district office to which the petition is or will be assigned (See N.J.A.C. 12:235-3.1 for claim petition filing and assignment).

(b) The notice of motion for emergent medical care shall be on a form prescribed by the Division and shall contain or be accompanied by the following:

1. A statement by the petitioner or the petitioner's attorney of the specific request(s) for medical treatment made by the petitioner or the petitioner's attorney to the employer and/or the employer's insurance carrier, including the name of the person(s) to whom the request(s) was/were made;

2. Medical documentation, including a statement by a physician indicating that the petitioner is in need of emergent medical care, that the delay in treatment will result in irreparable harm or damage to the petitioner and the specific nature of the irreparable harm or damage;

3. All medical records relating to the requested medical care, which are in the possession of the petitioner or the petitioner's attorney;

4. Copies of the claim petition and answer.

i. If no answer to the claim petition has been filed, the notice of motion shall include the following information if known by the petitioner: the telephone number and the fax number of the employer, the name of the employer's workers' compensation insurance carrier and the insurance carrier or self-insured employer contact person's telephone number and fax number, as required to be maintained under N.J.A.C. 12:235-3.4; and

5. Proof of service under (c), (d) and (e) below.

(c) Where an answer to the claim petition has been filed by the respondent, the notice of motion and supporting papers shall be served on respondent's attorney by fax and by a one-day delivery service.

(d) Where no answer to the claim petition has been filed by the respondent, the notice of motion and supporting papers shall be served on the employer and, if known by the petitioner, upon the employer's insurance carrier.

1. Service on the employer under this subsection shall be either by personal service or by fax and a one-day delivery service.

2. Service on the insurance carrier under this subsection shall be by fax and a one-day delivery service to the contact person listed pursuant to N.J.A.C. 12:235-3.4.

(e) Where the employer is uninsured or where the employer's insurer is not known by the petitioner, the notice of motion and supporting papers shall, in addition to the requirements under (c) or (d) above, be served on the Uninsured Employer's Fund by fax and by a one-day delivery service.

(f) The date of the personal service, the date of the fax service or the date of receipt of the one-day delivery service, whichever is latest, shall be considered the date of service under (c), (d) and (e) above.

(g) No later than five calendar days after receiving service of the petitioner's notice of motion for emergent medical care, the respondent shall file with the district office an answer to the motion.

(h) Within 15 calendar days after the petitioner has served the notice of motion for emergent medical care upon the appropriate party or parties under (c), (d) and (e) above, the employer or the employer's insurance carrier may have a medical examination of petitioner conducted.

(i) The petitioner is required to attend and cooperate with the medical examination process under (h) above.

(j) Motions for emergent medical care shall take precedence over all other court listings.

(k) The judge should use telephone conferences and afternoon hearings, as appropriate, to expedite the disposition of motions for emergent medical care and to avoid as much as possible the disruption of other court proceedings.

(l) Within five calendar days of the filing of an answer by respondent or, if no answer has been filed, within five calendar days from the date an answer should have been filed, an initial conference on the motion for emergent medical care shall take place.

(m) The district office shall provide notice of the initial conference to the following parties under the following circumstances:

1. Where an answer to the notice of motion for emergent medical care has been filed, the district office shall provide notice of the initial conference by telephone and fax to the petitioner's attorney or petitioner pro se and to the answering party using the telephone numbers and fax numbers indicated in the notice of motion for emergent medical care and the answer, respectively;

2. Where an answer to the notice of motion for emergent medical care has not been filed and where the employer is insured, the district office shall provide notice of the initial conference by telephone and fax to the employer and to the insurance carrier contact person listed in the notice of motion for emergent medical care; or

3. Where an answer to the notice of motion for emergent medical care has not been filed and where the employer is not insured or the insurer is not known, the district office shall provide notice of the initial conference by telephone and fax to the employer and to the Uninsured Employer's Fund.

(n) If the motion for emergent medical care has not been resolved at the initial conference and the employer or the employer's insurance carrier has not requested a medical examination of the petitioner under (h) above, the judge shall hold a hearing on the merits of the motion for emergent medical care as soon as is practicable, but no later than five calendar days from the date of the initial conference.

(o) If the motion for emergent medical care has not been resolved at the initial conference and the employer or employer's insurance carrier has requested a medical examination of the petitioner under (h) above, the judge shall hold a hearing on the merits of the motion for emergent medical care as soon as is practicable after the medical examination of the petitioner, but no later than five calendar days from the date of the medical examination of the petitioner.

(p) With regard to the hearing on the merits of the motion for emergent medical care, the judge may require a continuous trial or may use other procedures to ensure that the motion is expeditiously heard.

(q) The judge hearing the motion for emergent medical care shall render a decision and issue an order on the motion within one business day of the conclusion of the trial testimony.

(r) The judge may supplement the decision and order rendered under(q)above at a later date.

(s) If a motion for emergent medical care does not meet the requirements under this section, but does meet the requirements for a general motion for temporary and/or medical benefits under N.J.A.C. 12:235-3.3, the motion shall be listed and proceed as a general motion for temporary and/or medical benefits.

12:235-3.4 Insurance carrier or self-insured employer contact person procedures pursuant to N.J.S.A. 34:15-15.4

(a) Every insurance carrier providing workers' compensation insurance and every workers' compensation self-insured employer shall designate a contact person who is responsible for responding to issues concerning medical and temporary disability benefits where no claim petition has been filed or where a claim petition has not been answered.

(b) The contact person referred to in (a) above shall also receive notice of motions for emergent medical care under N.J.A.C. 12:235-3.3.

(c) The full name, telephone number, mailing address, e-mail address and fax number of the contact person referred to in (a) above shall be submitted to the Division utilizing the Division's contact person form in the manner instructed on the form.

(d) The Division's contact person form shall be made available on the Division's website and at the Division's district offices.

(e) Any changes of contact person or in information about the contact person shall be immediately submitted to the Division using the Division's contact person form.

(f) After an answer to a claim petition has been filed, the attorney of record for the respondent shall be the point of contact for issues concerning temporary disability and/or medical benefits.

(g) A contact person roster using the information provided under (c) above will be available on the Division's website.

(h) Failure to comply with the requirements of N.J.S.A. 34:15-15.4 or this section shall result in a fine of $2,500 for each day of noncompliance, which fine shall be payable to the Second Injury Fund.

1. The Division shall send notice of noncompliance and of the fine amount by certified mail, return receipt requested, to the business address of the insurance carrier or self-insured employer.

2. The insurance carrier or self-insured employer shall have 30 calendar days to pay the fine or to contest the fine.

3. Where the insurance carrier or self-insured employer contests the fine, the Division shall hold a conference in an attempt to resolve the dispute.

Recodify existing N.J.A.C. 12:235-3.3 through 3.13 as 3.5 through 3.15 (No change in text.)

12:235-3.16 Enforcement

(a) A party may, by written motion pursuant to N.J.A.C. 12:235-3.5(a) and (b), move against an employer, insurance carrier, petitioner, case attorney or any other party to a claim petition for enforcement of any court order or for the enforcement of the requirements of the workers' compensation statute or rules.

(b) The motion under (a) above shall identify the order, statute or regulation sought to be enforced.

(c) The party against whom the motion has been brought shall file a written response to the motion within 14 calendar days of the notice of motion.

(d) The response under (c) above shall include the reasons for any noncompliance and the manner and time period to ensure compliance.

(e) Any time after the 14-day period to respond under (c) above has elapsed and on notice to the parties, the judge shall hold a hearing on the motion.

(f) A judge on his or her own motion may at any time, upon notice to the affected parties, move to enforce a court order or to enforce the requirements of the workers' compensation statute or rules.

(g) Prior to ruling on a motion under (f) above, the judge shall provide the parties an opportunity to respond to the motion and to be heard on the record.

(h) Upon a finding by a judge of noncompliance with a court order or the workers' compensation statute or rules, the judge, in addition to any other remedy provided by law, may take any or all of the following actions:

1. Impose costs and simple interest on any monies due.

i. The judge may impose an additional assessment not to exceed 25 percent on any moneys due if the judge finds the payment delay to be unreasonable;

2. Levy fines or other penalties on parties or case attorneys in an amount not to exceed $5,000 for unreasonable delay or continued noncompliance.

i. A fine shall be imposed by the judge as a form of pecuniary punishment.

ii. A penalty shall be imposed by the judge to reimburse the Division's administrative costs.

iii. The proceeds under this paragraph shall be paid into the Second Injury Fund;

3. Close proofs, dismiss a claim or suppress a defense as to any party;

5. Take other appropriate case-related action to ensure compliance; and/or

6. Allow a reasonable counsel fee to a prevailing party, where supported by an affidavit of services.

(i) Upon a finding by a judge of noncompliance by a party with a court order or the workers' compensation law or rules, the judge, in addition to any other remedy provided by law, may hold a separate hearing on the issue of contempt.

(j) Following a hearing under (i) above and upon a finding by the judge of contempt, the successful party in the contempt hearing or the judge may file a motion with the Superior Court for contempt action.

(k) Any fine, penalty, assessment or cost imposed by a judge under this section shall be paid by the entity or party found to be in noncompliance and shall not be included in the expense base of an insurance carrier for the purpose of determining rates or as a reimbursement or case expense.

Recodify existing N.J.A.C. 12:235-3.15 and 3.16 as 3.17 and 3.18 (No change in text.)

12:235-7.1 Purpose; scope

(a)-(d) (No change.)

(e) A petitioner may move to relax or dispense with requirements under this subchapter.

1. After a hearing on the motion to relax or dispense with requirements under this subchapter, the judge may grant the motion upon a finding that the subject requirements under the particular facts of the case are unduly burdensome and that grant of the motion would not adversely affect the UEF.

(f) Where petitioner seeks current medical treatment and/or temporary disability benefits and the only issue is the cancellation or non-renewal of an insurance policy, the judge may order the insurance carrier to provide treatment and/or benefits without prejudice and subject to reimbursement by the employer or, if not paid by the employer, by the UEF, if it is subsequently determined that the policy was not in effect.

(g) (No change in text.)

12:235-7.4 Medical bills; physician's examination

(a) Any medical bills or charges for which petitioner seeks payment from the UEF must be timely submitted by the petitioner to the UEF and be supported by the following:

1. Related treating records, itemized bills and a physician's report, which reflects that the bills and charges were reasonable, necessary and causally related to the work accident or occupational exposure alleged in the claim petition; and

2. Other necessary medical documentation or information required by the UEF.

(b) Any dispute under this section concerning the treating records, bills, physician's report or UEF request for other medical documentation or information shall be determined by the judge after a hearing upon oral or written motion by the UEF or another party.

For more information concerning medical care and workers’ compensation click here.

Saturday, January 11, 2014

Ex-NJ Mayor and Insurance Agent Sentenced On Charges Involving Workers' Compensation Insurance Scheme

Related articles

Consumers Beware: Not All Health Plans Cover A Doctor's Visit Before The Deductible Is Met

A California Lesson: How to Kill Workers' Compensation Pill By Pill

NJ COLA Bill Passed by Senate

Coordination of Benefits and Non-Group Health Plan Recovery Transition

AIA to Urge Renewal of TRIA to Workers Compensation

Tuesday, November 25, 2008

CMS Announces Future Tele-Conferences for MSP Reporting

January 22, 2009 - Liability (including Self-Insurance), No-Fault Insurance and Workers' Compensation

January 28, 2009 - Liability (including Self-Insurance), No-Fault Insurance and Workers' Compensation

February 25, 2009 - Liability (including Self-Insurance), No-Fault Insurance and Workers' Compensation

March 25, 2009 - Liability (including Self-Insurance), No-Fault Insurance and Workers' Compensation

April 22, 2009 - Liability (including Self-Insurance), No-Fault Insurance and Workers' Compensation

Tuesday, January 21, 2020

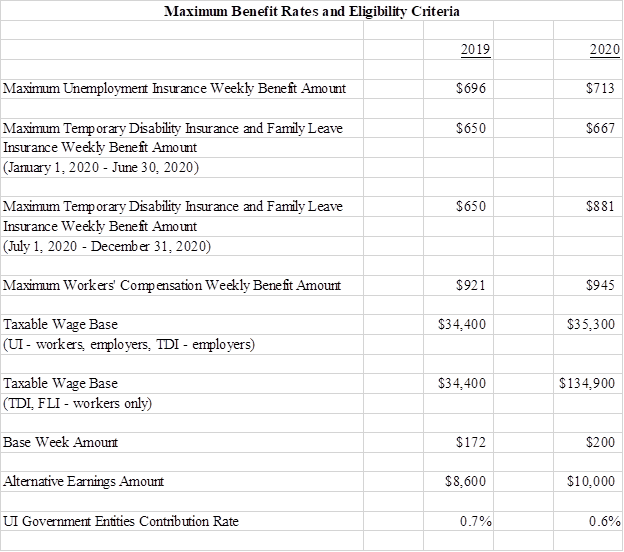

NJ Announces Increases in Maximum Benefit Rates & Taxable Wage Base

To read more about "rates" and workers' compensation, click here.

….

Jon L. Gelman of Wayne NJ is the author of NJ Workers’ Compensation Law (West-Thomson-Reuters) and co-author of the national treatise, Modern Workers’ Compensation Law (West-Thomson-Reuters). For over 4 decades the Law Offices of Jon L Gelman 1.973.696.7900 jon@gelmans.com has been representing injured workers and their families who have suffered occupational accidents and illnesses.

Monday, September 15, 2014

Flaw In Federal Software Lets Employers Offer Plans Without Hospital Benefits, Consultants Say

| A flaw in the federal calculator for certifying that insurance meets the health law’s toughest standard is leading dozens of large employers to offer plans that lack basic benefits such as hospitalization coverage, according to brokers and consultants. The calculator appears to allow companies enrolling workers for 2015 to offer inexpensive, substandard medical insurance while avoiding the Affordable Care Act’s penalties, consumer advocates say. Insurance pros are also surprised such plans are permitted. Employer insurance without hospital coverage “flies in the face of Obamacare,” said Liz Smith, president of employee benefits for Assurance, an Illinois-based insurance brokerage. At the same time, a kind of catch-22 bars workers at these companies from subsidies to buy more comprehensive coverage on their own through online marketplaces. No federal tax credits for health coverage are available to people with workplace plans approved by the calculator. The calculator is used by self-insured employers, which include most large firms. Like insurance companies, self-insured employers must certify that their plans pass health-law standards for consumer value. One official way to do that is to get a passing score on the Department of Health and Human Services’ “minimum-value” calculator, an online tool. An employer checks boxes on the screen indicating what... |

….

Jon L. Gelman of Wayne NJ is the author of NJ Workers’ Compensation Law (West-Thompson-Reuters) and co-author of the national treatise, Modern Workers’ Compensation Law (West-Thompson-Reuters). For over 4 decades the Law Offices of Jon L Gelman 1.973.696.7900 jon@gelmans.com have been representing injured workers and their families who have suffered occupational accidents and illnesses.

Related articles

- Consumers Will Owe Uncle Sam If They Got Health Insurance Subsidies Mistakenly (workers-compensation.blogspot.com)

- For Workers Leaving Their Jobs, Health Exchanges Offer Insurance Choices Beyond COBRA (workers-compensation.blogspot.com)

- Employers Eye Moving Sickest Workers To Insurance Exchanges (workers-compensation.blogspot.com)

- Are Your Medical Records Vulnerable To Theft? (workers-compensation.blogspot.com)

- Health Spending Over The Coming Decade Expected To Exceed Economic Growth (workers-compensation.blogspot.com)

- No Shopping Zone: Medicare Is Not Part Of New Insurance Marketplaces (workers-compensation.blogspot.com)

- In Hollywood, Health Coverage Presents Unique Challenges (workers-compensation.blogspot.com)