A recent study about the impact of legal representation on workers' compensation benefits found that having an attorney representing an injured worker increases benefits.

Copyright

Friday, December 6, 2024

Wednesday, September 14, 2022

Uber Pays $100M Fine in NJ Driver Misclassification Case

Uber Technologies Inc. and a subsidiary have submitted a $100 million payment to the New Jersey Department of Labor and Workforce Development’s (NJDOL’s) Unemployment Trust Fund after an audit found the ride-share companies improperly classified hundreds of thousands of drivers as independent contractors, depriving them of crucial safety-net benefits such as unemployment, temporary disability, and family leave insurance, and failed to make required contributions toward unemployment, temporary disability, and workforce development.

Monday, January 25, 2021

"Made in America" Will Impact Workers' Compensation Nationally

Today, President Biden signed the Executive order, Made in America.” The effort to move manufacturing jobs back to the United States will have a major impact going forward for the entire workers' compensation system. This initiative will expand the workforce and expand the potential of a major increase in workers' compensation benefits through increased wages/rates and premiums paid for coverage and all related cottage industries involved in the social insurance program.

Friday, November 20, 2020

Underpayment of Wages Impact Workers’ Compensation Claims

Tuesday, September 22, 2020

NJ "Hand and Foot" Clarification Bill Advances

Tuesday, January 21, 2020

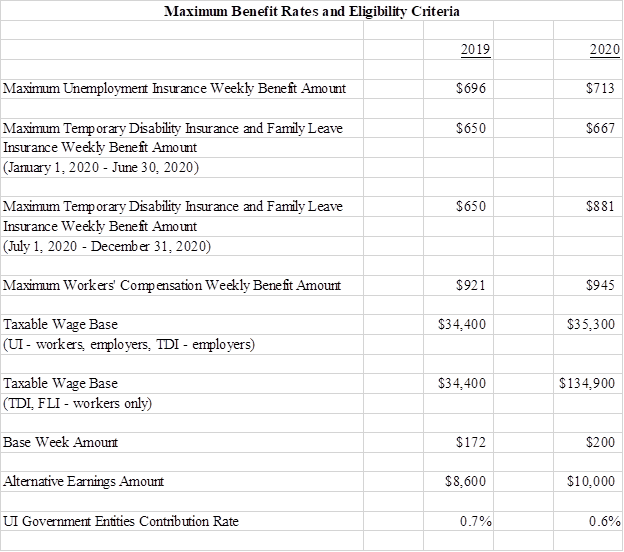

NJ Announces Increases in Maximum Benefit Rates & Taxable Wage Base

To read more about "rates" and workers' compensation, click here.

….

Jon L. Gelman of Wayne NJ is the author of NJ Workers’ Compensation Law (West-Thomson-Reuters) and co-author of the national treatise, Modern Workers’ Compensation Law (West-Thomson-Reuters). For over 4 decades the Law Offices of Jon L Gelman 1.973.696.7900 jon@gelmans.com has been representing injured workers and their families who have suffered occupational accidents and illnesses.

Saturday, June 15, 2019

Firefighter and Public Safety Officer Presumption Bill Advances

The following bill(s) have been scheduled for a committee or a legislative session.

A1741:

Quijano, Annette/Benson, Daniel R./Lagana, Joseph A.

"Thomas P. Canzanella Twenty First Century First Responders Protection Act"; concerns workers' compensation for public safety workers.

6/20/2019 1:00:00 PM Assembly

Voting Session

Assembly Chambers

http://www.njleg.state.nj.us/bills/BillView.asp?BillNumber=A1741

S716:

Greenstein, Linda R./Bateman, Christopher

"Thomas P. Canzanella Twenty First Century First Responders Protection Act"; concerns workers' compensation for public safety workers.

6/20/2019 1:00:00 PM Assembly

Voting Session

Assembly Chambers

http://www.njleg.state.nj.us/bills/BillView.asp?BillNumber=S716

Updated: 06-15-2019

Wednesday, May 8, 2019

New Penalties Proposed for Employers

Friday, April 12, 2019

NJ Monitors Wages: A Benefit for Injured Workers

Tuesday, December 18, 2018

NJ Senate passes bill to increase benefits for hand and foot claims

Identical Bill Number: A1110

Last Session Bill Number: S777 A4376 Sarlo, Paul A. as Primary Sponsor Scutari, Nicholas P. as Primary Sponsor | ||||

| 1/9/2018 Introduced in the Senate, Referred to Senate Labor Committee 5/10/2018 Reported from Senate Committee, 2nd Reading 5/10/2018 Referred to Senate Budget and Appropriations Committee 9/24/2018 Reported from Senate Committee with Amendments, 2nd Reading 12/17/2018 Passed by the Senate (27-8) Introduced - - 10 pages PDF Format HTML Format Technical Review Of Prefiled Bill - - 9 pages PDF Format HTML Format Statement - SLA 5/10/18 - 1 pages PDF Format HTML Format Reprint - - 9 pages PDF Format HTML Format Statement - SBA 9/24/18 - 3 pages PDF Format HTML Format Fiscal Estimate - 10/3/18;1R - 4 pages PDF Format HTML Format Committee Voting: SLA 5/10/2018 - r/favorably - Yes {4} No {1} Not Voting {0} Abstains {0} - Roll Call SBA 9/24/2018 - r/Sca - Yes {10} No {0} Not Voting {1} Abstains {2} - Roll Call Session Voting: Sen. 12/17/2018 - 3RDG FINAL PASSAGE - Yes {27} No {8} Not Voting {5} - Roll Call | ||||

Sunday, September 23, 2018

NJ Legislature Advances Increase to Work Comp Benefits & Proposes System Study

The committee vote was as follows:

SBA 9/24/2018 - r/Sca - Yes {10} No {0} Not Voting {1} Abstains {2} - Roll Call

Sarlo, Paul A. (C) - Yes Stack, Brian P. (V) - Yes Addiego, Dawn Marie - Abstain

Bucco, Anthony R. - Not Voting Cruz-Perez, Nilsa - Yes Cunningham, Sandra B. - Yes

Greenstein, Linda R. - Yes O'Scanlon, Declan J., Jr. - Yes Oroho, Steven V. - Yes

Pou, Nellie - Yes Ruiz, M. Teresa - Yes Thompson, Samuel D. - Abstain

Weinberg, Loretta - Yes

Updated: 9/25/18 10:42am

Wednesday, September 5, 2018

Totally Injured Workers Maybe Getting an Increase in Benefits

Wednesday, April 25, 2018

Equal Pay for Equal Work Now Law in New Jersey - Legislation Signed

Sunday, October 8, 2017

NASI Study: Employers & Employees Lose With Workers' Compensation

Friday, December 2, 2016

Insurance Rating Company Increases Estimate for Net Ultimate U.S. Asbestos Losses to $100 Billion

Monday, April 18, 2016

Creating a Competitive Economy: The Verizon Strike

|

| President Barack ObamaPhoto credit: Wikipedia |

Wednesday, May 6, 2015

Professor John F Burton Jr: Illinois Proposed Changes Are Obectionable

|

| Professor John F. Burton Jr. |

Tuesday, April 22, 2014

Wage Theft -- Another Assault on Workers' Compensation

| As corporate American devises new methods to reduce wages it also assaults the injured workers' benefit safety net including workers' compensation insurance. It results in rate benefits to go down and premium bases to become inadequate to pay on gong claims. Today's post is shared from nytimes.com and is authored by it's Editorial Board. When labor advocates and law enforcement officials talk about wage theft, they are usually referring to situations in which low-wage service-sector employees are forced to work off the clock, paid sub minimum wages, cheated out of overtime pay or denied their tips. It is a huge and under policed problem. It is also, it turns out, not confined to low-wage workers. In the days ahead, a settlement is expected in the antitrust lawsuit pitting 64,613 software engineers against Google, Apple, Intel and Adobe. The engineers say they lost up to $3 billion in wages from 2005-9, when the companies colluded in a scheme not to solicit one another’s employees. The collusion, according to the engineers, kept their pay lower than it would have been had the companies actually competed for talent. The suit, brought after the Justice Department investigated the anti-recruiting scheme in 2010, has many riveting aspects, including emails and other documents that tarnish the reputation of Silicon Valley as competitive and of technology executives as a new breed of “don’t-be-evil” bosses, to cite Google’s informal motto. The case... [Click here to see the rest of this post]  Workers' Compensation: Would Higher Minimum Wage for ... Workers' Compensation: Would Higher Minimum Wage for ...Apr 17, 2014 Wages determine rates of workers' compensation. The lowest wage earners go unnoticed in the struggle to increase benefits. Today's post is shared from njspotlight.com . Advocates decry current $2.13 per hour as unfair, ... http://workers-compensation.blogspot.com/ Payroll Data Shows a Lag in Wages, Not Just Hiring Feb 11, 2014 But the report also made plain what many Americans feel in their bones: Wages are stuck, and barely rose at all in 2013. They were up 1.9 percent last year, or a mere 0.4 percent after accounting for inflation. Not only was that ... http://workers-compensation.blogspot.com/ McDonald's Accused of Stealing Wages From Already ... Mar 16, 2014 McDonald's Accused of Stealing Wages From Already Underpaid Workers. Wage are the basic factor upon which to calculate rates for workers' compensation purposes. Today's post was shared by Mother Jones and comes ... http://workers-compensation.blogspot.com/ |

Sunday, March 16, 2014

McDonald's Accused of Stealing Wages From Already Underpaid Workers

Today's post was shared by Mother Jones and comes from www.motherjones.com

Wage-theft suits brought against McDonald's this week in Michigan, California, and New York accuse the chain of refusing to pay overtime, ordering people to work off the clock, and straight up erasing hours from timecards. If these allegations are true, and maybe they're not, but maybe they are, then the company has been illegally screwing people who are already being legally screwed. This is the most recent development in a months-long campaign by fast-food workers pushing for a $15/hour starting wage. You shouldn't eat fast food because fast food is bad for you but if you do eat fast food (and you will eat fast food at least once in a while because nobody can be perfect all the time), be nice to the people who serve you. They have to fight tooth and nail to make ends meet. Could you make it on fast food wages? Here's a depressing calculator. (Spoiler: Probably not!) |

Wednesday, February 19, 2014

World Trade Center Fund Now Covers Myeloid Malignancies

These cancers had been considered non-malignant by the Administrator because they were referred to as “pre-leukemic” hematopoietic disorders in the medical literature. Recent scientific advances, however, characterize these “pre-leukemic” myeloid neoplasms as slow-growing blood cancers, and authoritative scientific sources now consider them to be malignant myeloid neoplasms.

After receiving a request from the WTC Clinical Centers of Excellence to review certain myeloid disorders in terms of their status as malignancies, the WTC Health Program has determined that, in addition to types of leukemias, these myeloid malignancies are eligible for coverage by the WTC Health Program as WTC-related health conditions.

The group of myeloid malignancies includes the following health conditions:

(1) Myelodysplastic Syndromes (MDSs);

(2) Myeloproliferative neoplasms (MPNs);

(3) Myelodysplastic/myeloproliferative neoplasms (MDS/MPN); and

(4) Myeloid malignancies associated with eosinophilia and abnormalities of growth factor receptors derived from platelets or fibroblasts.

On January 2, 2010, President Barack Obama signed the James Zadroga 9/11 Health and Compensation Act establishing the World Trade Health Program and extends and expands eligibility for compensation under the September 11th Victim Compensation Fund of 2001.

For over 3 decades the Law Offices of Jon L. Gelman 1.973.696.7900 jon@gelmans.com have been representing injured workers and their families who have suffered asbestos related disease. Please contact our office if you require assistance in filing a claim under the newly enacted James Zadroga 9/11 Health and Compensation Act.

Related articles

- OSHA announces proposed new rule to improve tracking of workplace injuries and illnesses (workers-compensation.blogspot.com)

- 'Bakers contract cancer from asbestos in old ovens': tv programme (workers-compensation.blogspot.com)

- Why Everyone Seems to Have Cancer (workers-compensation.blogspot.com)

- CMS Takes a New Direction in the Proposed MSP Appeal Process (workers-compensation.blogspot.com)

- Obama to Raise Minimum Wage for Federal Contractors, Asserting Executive Power (workers-compensation.blogspot.com)

- The 50-year war on smoking (workers-compensation.blogspot.com)