Copyright

Thursday, May 14, 2020

Senators Call For Creation of New Workers Compensation Fund to Support Essential Frontline Workers

Friday, February 14, 2020

Restoring Overtime

Wednesday, January 22, 2020

NJ Governor Murphy Signs Sweeping Legislative Package to Combat Worker Misclassification and Exploitation

Tuesday, January 21, 2020

NJ Offers Tax Credits to Employers to Offset Minimum Wage Increases for Workers with Impairments

To read more about "minimum wage" and workers' compensation, click here.

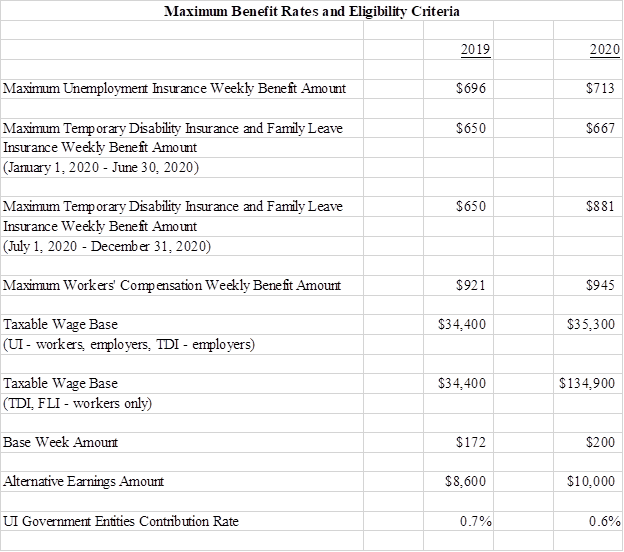

NJ Announces Increases in Maximum Benefit Rates & Taxable Wage Base

To read more about "rates" and workers' compensation, click here.

….

Jon L. Gelman of Wayne NJ is the author of NJ Workers’ Compensation Law (West-Thomson-Reuters) and co-author of the national treatise, Modern Workers’ Compensation Law (West-Thomson-Reuters). For over 4 decades the Law Offices of Jon L Gelman 1.973.696.7900 jon@gelmans.com has been representing injured workers and their families who have suffered occupational accidents and illnesses.

Thursday, July 4, 2019

Fighting Wage Preemption: How Workers Have Lost Billions in Wages and How We Can Restore Local Democracy

Local governments, like cities and counties, have long implemented local policies—including higher minimum wages—to improve economic conditions.

Local efforts to raise the wage floor have seen a tremendous upsurge over the past six years, mostly as a result of the Fight for $15 movement, which began in late November 2012 in New York when fast food workers walked off the job, demanding

$15 and a union. The movement quickly spread throughout the country, and its impact has been remarkable: More than 40 cities and counties have adopted their own minimum wage laws, and as of late 2018, an estimated 22 million workers have won $68 billion in raises since the Fight for $15 began.

In response to this explosion in local minimum wage activity, a number of states— particularly those with conservative legislatures—have sought to shut down these gains by adopting “preemption” laws that prohibit cities and counties from adopting local minimum wages, as well as a wide range of other pro-worker policies. The state preemption of local minimum wages disenfranchises workers and exacerbates racial inequality when it disproportionately impacts communities of color who are overrepresented among low-wage workers1 and who often represent majorities in our cities and large metro areas.

The most significant force behind the recent wave of preemption laws nationwide is the corporate lobby. Failing to stop the adoption of local pro-worker laws, the corporate lobby has persuaded state-level lawmakers to revoke the underlying local authority to adopt such policies, in some cases rolling back wage increases that were already enacted by city and county governments. In doing so, the corporate lobby has not only captured the political lever closest to the people (their city or county government), it has also hampered the democratic process at its most intimate level.

A total of 25 states have statutes preempting local minimum wage laws. To date, 12 cities and counties in six states (Alabama, Iowa, Florida, Kentucky, Missouri, and Wisconsin) have approved local minimum wage laws only to see them invalidated by state statute, harming hundreds of thousands of workers in the process, many of whom face high levels of poverty.

Click here to read more

Wednesday, July 3, 2019

NJ Governor Murphy Marks Statewide Minimum Wage Increase Taking Effect Today

“Today marks a monumental step on our path to a stronger and fairer New Jersey,” said Governor Murphy. “Our economy grows when everyone can participate in it – every hardworking New Jerseyan deserves a fair wage that allow them to put food on the table and gas in their car. Together, we are making New Jersey more affordable and giving over a million New Jerseyans a pathway to the middle class.”

Under the law Governor Murphy signed in February, after today's increase, the statewide minimum wage will continue to increase by $1 per hour every January 1st until it reaches $15 per hour on January 1, 2024.

For seasonal workers and employees at small businesses with five or fewer workers, the base minimum wage will reach $15 per hour by January 1, 2026. By January 1, 2028, workers in these groups will receive the minimum wage inclusive of inflation adjustments that take place from 2024 to 2028, equalizing the minimum wage with the main cohort of New Jersey workers.

For agricultural workers, the base minimum wage will increase to $12.50 per hour by January 1, 2024. No later than March 31, 2024, the New Jersey Labor Commissioner and Secretary of Agriculture will jointly decide whether to recommend that the minimum wage for agricultural workers increase to $15 per hour by January 1, 2027, as specified in the bill. If they cannot come to an agreement, a third member, appointed by the Governor with the advice and consent of the Senate, will break the tie. If there is a recommendation to disapprove of the scheduled increases or suggest an alternative pathway, the Legislature will have the ability to implement that recommendation by passage of a concurrent resolution.

“Today’s minimum wage increase to $10 per hour gives low-wage families firmer ground on which to stand and moves us closer to Governor Murphy’s vision of a stronger, fairer economy. The law’s multi-year phase-in to $15 per hour gives the state’s businesses the time they need to adjust to the higher wage requirements,” said Labor Commissioner Robert Asaro-Angelo.

"The fight for a living wage takes a step in the right direction today, when New Jersey's minimum wage will be raised to $10,” said Sue Altman, CEO of Working Families. “This is a long-fought victory by labor, grassroots activists, and advocates, and we commend Governor Murphy and legislative leadership for taking action. With every raise in the wage toward our fight for $15, we secure greater economic justice for working people across New Jersey, who can now support their families by covering the basics and buying goods and services from New Jersey businesses."

“New Jersey small business owners understand what’s good for their employees and businesses, and that starts by putting New Jersey workers on the road to be paid a livable wage,” said Raj Bath, Business Representative for the New Jersey Main Street Alliance. “Paying workers a decent livable wage means they will play a vital part in the local economy which is a win-win for Main Street. New Jersey will have a thriving economic future as long as we continue to invest in our middle-class workers and our Main Street.”

“As SEIU’s flagship campaign, 32BJ SEIU worked tirelessly for years to see the minimum wage in New Jersey begin its rise to $15.00,” said Kevin Brown, SEIU 32BJ Vice President and New Jersey District Director. “Today our uphill battle finally pays off as the lowest paid people in our community earning $8.85/hour take home $10.00/hour instead. This is a real and meaningful change for the lives of over one million working families who will benefit from the long-lasting economic impacts of this legislation. Our union sisters and brothers rallied, canvassed and fought to raise the bar for the entire state because we know that a rising tide lifts all boats, and it starts from the bottom. We thank Governor Murphy, the legislature, and the support of labor allies behind us. We will celebrate again when the minimum wage increases to $11.00 on January 1, 2020, and 32BJ will continue to lead in the fight for working people, immigrants and people of color who deserve better.”

“At times, we don't even know if we'll be able to pay rent with what we make,” said Rosa Fernandez of New Labor. “With a minimum wage raise now and every January until 2024, workers around New Jersey can make ends meet and breathe a little easier.”

“As the minimum wage begins to increase on July 1, New Jersey is taking an historic step towards a dignity wage for about one million workers who are mostly people of color, women, and low-wage workers,” said Renee Koubiadis, Executive Director of the Anti-Poverty Network of New Jersey. “With the increase to $10 an hour, more individuals and families will be able to afford basic needs instead of going without.”

"Raising New Jersey's minimum wage to $15 an hour is one of the most consequential, pro-worker policies passed in decades," said Brandon McKoy, President of New Jersey Policy Perspective. "With the first increase to $10.00 an hour, approximately half a million workers will see a boost in their take home pay. This will help alleviate poverty and promote spending in local communities, benefiting workers, their children, and businesses alike."

"This next increase in the minimum wage will help many more working families put food on the table and pay bills,” said Dena Mottola Jaborska, Associate Director, New Jersey Citizen Action.“It's an important step forward to providing all New Jersey workers a livable wage. No one who works full time should struggle to make ends meet.”

“At Foley Waite LLC, our New Jersey architectural woodworking firm has employed skilled cabinet makers, helpers and apprentices since 1978,” said Kelly Conklin, Managing Partner at Foley Waite LLC. “We have supported raising the minimum wage from the start. Governor Murphy recognizes as we do, a living wage grows our economy, not in boardrooms and mansions, it grows the economy on Main Street. This increase is long overdue and we thank the Governor for his leadership on this critically important policy.”

“We're very happy New Jersey's minimum wage is increasing,” said Gail Friedberg, CEO of Zago Manufacturing. “We support a $15 minimum wage because no one who works full-time should live in poverty. And we know from experience that fair pay is better for business. It brings low turnover, which helps us innovate. With a higher wage floor and more dependable workforce, business owners can think about ways to make the business better instead of spending time and money to replace people who left to find a job that pays the bills. I look forward to seeing the economic ripple effect our state will experience thanks to raising the minimum wage."

“Today’s historic step toward $15 minimum wage with an increase to $10 dollars per hour from $8.85 dollars per hour will give the working men and women the pay that they deserve,” said Tony Sandkamp, CEO of Sandkamp Woodworks. “At Sandkamp Woodworks, we stand with the Governor’s commitment to increase the wage so that every person in the state has the opportunity to improve their lives whether it be providing for their families or meeting their financial needs.”

“At Bergen New Bridge, we have been committed to ensure that workers at our hospital are paid wages of $15 per hour,” said Deborah Visconi, Bergen New Bridge Medical Center. “We applaud the Governor for his efforts to bring this issue on a statewide level, providing every resident of New Jersey the compensation they deserve.”

Wednesday, August 1, 2018

NJ Workers' Compensation Rates to Increase in 2019

Friday, July 14, 2017

The Rise and Fall of Workers' Compensation - The Path to Federalization

Friday, September 2, 2016

Labor Day: Protecting Our Children

Sunday, April 3, 2016

Consequences of Increasing the Minimum Wage

Thursday, July 23, 2015

Misclassification: US Dept of Labor Issues Interpretation of Employment Status

Sounding very much like a workers' compensation standardized employment status test, the US Department of Labor has added its interpretation this developing area of the law. This memo will has obvious added consequences to state interpretation to this issue.

Friday, February 20, 2015

This Chart Shows What Walmart's Pay Raises Mean for the Minimum Wage

In a move set to reignite the debate over increasing the federal minimum wage, Walmart said Thursday it’s giving half a million of its employees a raise.

Here’s what’s in store for the 500,000 employees who are paid the company’s baseline wages (which are highly contested numbers), according to a statement:

What do Walmart’s raises really mean in context of the minimum wage debate?

As the world’s largest retailer, Walmart’s actions will likely provide a boost to those who want to bump up the federal minimum wage from $7.25 per hour to $10. Those efforts have repeatedly been blocked by some lawmakers in Congress, leading many states to pass their own laws establishing minimum wages above the federal level.

But supporters of a higher federal minimum wage have also called for the rate to be tied to inflation. Why? As inflation increases, the same amount of money buys less stuff — so that $7.25 could feel more like $6.50 or $5.75.

Take a look at the chart above: The federal minimum wage, shown in blue, has been increasing since 1938. But the purchasing power of that wage, shown in orange, has mostly been falling since 1968.

You might notice a slight uptick in the minimum wage’s purchasing power in recent years. That’s because inflation rates were unusually low in the wake of the Great Recession. But as the economy continues returning to normal, expect the minimum wage to lose purchasing power once again.

To bring it back to...

[Click here to see the rest of this post]

Related articles

- Walmart CEO Mike Duke Pushes Back Against Company's Minimum Wage Reputation (workers-compensation.blogspot.com)

- Labor's new reality -- it's easier to raise wages for 100,000 than to unionize 4,000 (workers-compensation.blogspot.com)

- Walmart workers plan Black Friday protests over wages (workers-compensation.blogspot.com)

- Raising the Minimum Wage Is Good for the Economy (workers-compensation.blogspot.com)

Thursday, January 15, 2015

Some 4.4 Million People Are About to Get a Raise

U.S. economyPhotographer: Andrew Burton/Getty Images Protesters demanding higher wages and unionization for fast food workers block traffic near Times Square on Sept. 4, 2014 in New York City. In his 2014 state of the union address, President Obama kicked off what could unofficially be dubbed the Year of the Minimum Wage. Just a year earlier, he had called for a $9 federal minimum, but there he was in early 2014, saying workers should earn at least $10.10 an hour. The shift shows how coordinated campaigns for higher wages, which started with fast-food workers and spread more broadly, raised expectations of what’s considered fair compensation. Obama’s call to raise the federal minimum may have gone unanswered, but states and cities picked up the torch. In 2014, 13 states passed legislation or initiatives to raise the wage floor, not just in Democratic strongholds but in red states as well. Now the results of those campaigns are starting to come to fruition nationwide. About 4.4 million people will see their pay go up for the new year, according to an analysis of census data by the Economic Policy Institute (EPI), which supports higher minimum pay. EPI’s data show that more than 750,000 workers earn the minimum wage in the 13 states that passed new raises in 2014. About two-thirds of those workers will see their wages go up on Jan. 1, and the rest will see their pay increase later in 2015. EPI estimates that in those 13... |

[Click here to see the rest of this post]

Saturday, December 27, 2014

Twenty states will raise their minimum wage on Jan. 1

The minimum wage will rise in 20 states and the District of Columbia on Thursday, as laws and automatic adjustments are made with the start of the new year. In nine states, the hike will be automatic, an adjustment made to keep the minimum wage in line with rising inflation. But in 11 states and D.C., the rise is the result of legislative action or voter-approved referenda, according to the left-leaning Economic Policy Institute. Two more states — Delaware and Minnesota — will get legislatively driven hikes later in the year. Twenty-nine states will have minimum wages above the federal minimum of $7.25. The size of the hikes range from 12 cents in Florida to $1.25 in South Dakota. Among those states hiking the minimum wage, Washington state’s will be highest at $9.47. Oregon’s is next at $9.25., followed by Vermont and Connecticut at $9.15. Massachusetts and Rhode Island will have $9 minimum wages. Of the states where the minimum wage is rising due to legislative or voter action, five — Alaska, Michigan, Minnesota, South Dakota, Vermont — and D.C. will also newly implement inflation indexing, bringing the number of states that tie future minimum wage hikes to inflation to 15. The minimum wage hikes will have a direct impact for nearly 2.3 million workers who currently earn less per hour than the new minimum wage. EPI estimates that an additional roughly 900,000 people would be affected indirectly, as... |

Saturday, December 20, 2014

Injured North Providence school custodian wins workers’ comp lawsuit against town

A North Providence school custodian recently won a workers’ compensation lawsuit against the town.

Joseph J. Adamczyk, who worked at Wayland Elementary School, in North Providence, injured his right shoulder on Aug. 21, 2013 while lifting a chest-high recycling bin filled with old books and being hit by the bin, court documents read. By mid-November of that year, he could no longer work.

Prior to that, he earned an average weekly paycheck of $683.26.

A physician later determined Adamczyk had an anterior/inferior labral tear. He had surgery for the injury in September 2014.

Judge Dianne M. Connor ruled on Dec. 12 that the town pay Adamczyk workers’ compensation benefits — partially disabled for some months and fully for other months –from November 2013 and continuing.

The judge also ordered the town reimburse the Rhode Island Temporary Disability Insurance Fund; pay Adamczyk for his medical treatment, rehabilitation costs, wages he may have earned from another employer while he was injured, and various court costs.

[Click here to see the rest of this post]

Related articles

- New Study: CA Disability Compensation Among Lowest in US Only Alabama & Rhode Island pay Lower Weekly Compensation (workers-compensation.blogspot.com)

- When Raising the Minimum Wage Isn't Enough (workers-compensation.blogspot.com)

- Using Workers' Compensation Records for Safety and Health Research (workers-compensation.blogspot.com)

- Illinois: Employer Convicted of a Felony for Failure to Have Workers' Compensation Insurance (workers-compensation.blogspot.com)

- National Trends and Developments in Workers' Compensation (workers-compensation.blogspot.com)

- New York State is committed to improving outdated workers' compensation system (workers-compensation.blogspot.com)

Friday, December 19, 2014

Fueled by Recession, U.S. Wealth Gap Is Widest in Decades, Study Finds

The wealthy are getting wealthier. As for everyone else, no such luck. A report released on Wednesday by the Pew Research Center found that the wealth gap between the country’s top 20 percent of earners and the rest of America had stretched to its widest point in at least three decades. Last year, the median net worth of upper-income families reached $639,400, nearly seven times as much of those in the middle, and nearly 70 times the level of those at the bottom of the income ladder. There has been growing attention to the issue of income inequality, particularly the plight of those earning the federal minimum wage of $7.25 an hour or close to it. But while income and wealth are related (the more you make, the more you can save and invest), the wealth gap zeros in on a different aspect of financial well-being: how much money and other assets you have accumulated over time, including the value of your home and car plus any investments in stocks, bonds and the like. Think of it as “a measure of the family ‘nest egg,’ ” as Pew calls it — a hoard that can sustain a household during an emergency, like the loss of a job, and in the long run can see someone through retirement. The wealth gap “exposes varying degrees of vulnerability,” said Valerie Wilson, an economist at the Economic Policy Institute, a left-of-center research group in Washington, adding that it also was passed down through the generations. While those at the top have... |

Related articles

- Aging Workers' Compensation (workers-compensation.blogspot.com)

- Holes in the Safety Net - Legal Immigrants' Access to Health Insurance (workers-compensation.blogspot.com)

- 12 Attacks On Workers' Rights That Will Make You Kinda Mad (workers-compensation.blogspot.com)

- Jobs are coming back, but they don't pay enough (workers-compensation.blogspot.com)

- Wages should be growing faster, but they're not. Here's why. (workers-compensation.blogspot.com)

Thursday, December 18, 2014

Two hotel industry groups sue L.A. over minimum wage hike

[Click here to see the rest of this post]

Read more about wages and workers' compensation

Related articles

- Wages should be growing faster, but they're not. Here's why. (workers-compensation.blogspot.com)

- Income inequality last year rose in 15 states (workers-compensation.blogspot.com)

- L.A., Central Valley have worst air quality, American Lung Assn. says (workers-compensation.blogspot.com)

- L.A. pays millions as police and firefighter injury claims rise (workers-compensation.blogspot.com)

- California is most expensive state for workers' comp (workers-compensation.blogspot.com)

- This is why wages have risen so slowly. (But the Fed can help!) (workers-compensation.blogspot.com)

- Jobs Report Becomes a Casualty of Shutdown (workers-compensation.blogspot.com)

Saturday, December 13, 2014

Elizabeth Warren is fighting Wall Street for the soul of the Democratic Party

Bill Clinton changed the Democratic Party, and Elizabeth Warren is trying to change it back — at least when it comes to Wall Street. The latest intra-party skirmish has come over the so-called "CRomnibus" (don't ask) spending bill that would have funded the government for the next year, as well as, among other pet projects, killed Dodd-Frank's prohibition on big banks using federally-insured money to make exotic bets. Now, that wouldn't gut financial reform by any means, but it would be the latest step in Wall Street's death-by-a-thousand-tweaks campaign against it. And that was too much for Warren, who led a liberal revolt against the bill that ultimately failed. But what would this derivatives change even do? Well, swaps are just bets on everything from interest rates to currencies to whether a company is going to go under or not. The way they work is one side promises to pay a fixed amount of money every, say, six months, and the other agrees to pay an amount tied to whatever they're betting on. So, for example, if you wanted to hedge your risk against interest rates rising, you might decide to pay a bank $3 million every half-year, and in return they would pay you $100 million multiplied by an agreed-upon interest rate (usually Libor). This might sound complicated, but the idea is simple: you're locking in borrowing costs of 3 percent—that's your $3 million divided by the same $100 million—and the other side is betting that rates won't be that... |

Related articles

- Missing Ingredient on Minimum Wage: A Motivated G.O.P. (workers-compensation.blogspot.com)

- California Doctors Prescribe More Name-Brand Drugs Than Any Other State (workers-compensation.blogspot.com)

- More Obamacare Enrollees In California Than In 36 States Combined (workers-compensation.blogspot.com)

- This is why wages have risen so slowly. (But the Fed can help!) (workers-compensation.blogspot.com)

- A Permanent Slump? (workers-compensation.blogspot.com)

Monday, December 8, 2014

Labor's new reality -- it's easier to raise wages for 100,000 than to unionize 4,000

Haltingly, with understandable ambivalence, the American labor movement is morphing into something new. Its most prominent organizing campaigns of recent years — of fast-food workers, domestics, taxi drivers and Wal-Mart employees — have prompted states and cities to raise their minimum wage and create more worker-friendly regulations. But what these campaigns haven't done is create more than a small number of new dues-paying union members. Nor, for the foreseeable future, do unions anticipate that they will. Blocked from unionizing workplaces by ferocious management opposition and laws that fail to keep union activists from being fired, unions have begun to focus on raising wages and benefits for many more workers than they can ever expect to claim as their own. In one sense, this is nothing new: Unions historically have supported minimum wage and occupational safety laws that benefited all workers, not just their members. But they also have recently begun investing major resources in organizing drives more likely to yield new laws than new members. Some of these campaigns seek to organize workers who, rightly or wrongly, aren't even designated as employees or lack a common employer, such as domestic workers and cab drivers. The decision of Seattle's government to raise the city's minimum wage to $15 resulted from just such... |

Related articles

- The Minimum Wage in America Is Pretty Damn Low (workers-compensation.blogspot.com)

- Study Finds Violations of Wage Law in New York and California (workers-compensation.blogspot.com)

- Is service work today worse than being a household servant? (workers-compensation.blogspot.com)

- Domestic Workers Treaty Goes Into Force (workers-compensation.blogspot.com)

- Chris Christie berated by U.S. Labor Secretary over minimum wage comments (workers-compensation.blogspot.com)